Screen-Free, Tactile

Financial Literacy

for K-10

| Hands‑on books and teacher support

| Used by 100+ schools and 15,000+ students

| Vetted by NYC Public Schools

Age-Anchored

Standards-Aligned

Math & Social Science Crosswalk

Financial literacy is a critical life skill, and at FiWe we ensure students have high-quality, engaging resources to learn it well.

Life and Career Readiness

FiWe equips students with the financial literacy skills they’ll carry into adulthood, from everyday money choices to planning for future careers.

Screen-Free Learning

As more schools embrace pen-and-paper activities to balance technology, FiWe offers interactive, screen-free resources that fit seamlessly into this shift.

Grade-Level Courses with Depth

Our programs are built for each stage of learning. In elementary school alone, students receive over 500 hours of financial literacy study time, creating a strong foundation for later grades.

STUDENT PROGRAMS

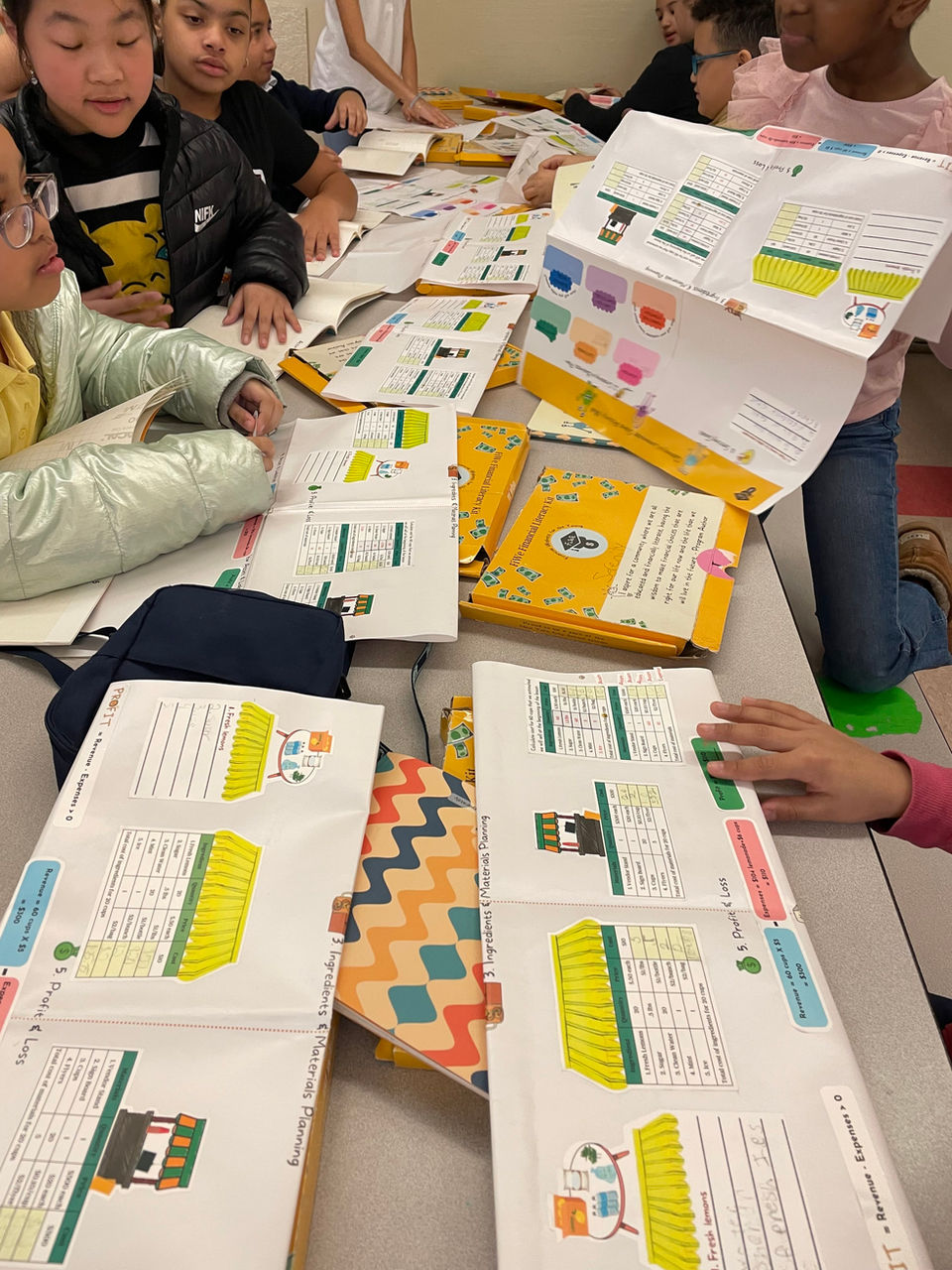

At FiWe, we've created tactile, hands-on resources that make financial literacy come alive for students. Our courses are grade-based and informed by the National Financial Educators Council’s (NFEC) financial literacy standards. They are scaffolded to build foundational knowledge around the five pillars of financial literacy:

-

Financial Psychology

-

Accounts, Savings, Budgeting & Investment

-

Credit, Debt & Loans

-

Income, Careers, Business & Entrepreneurship

-

Risk Management & Insurance

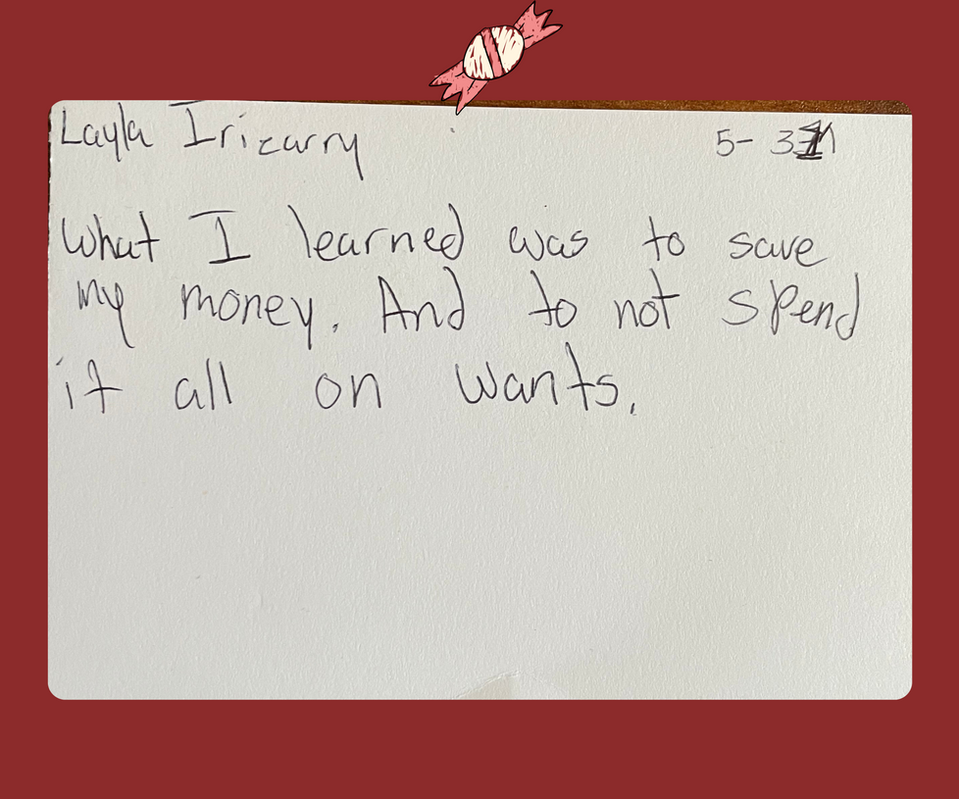

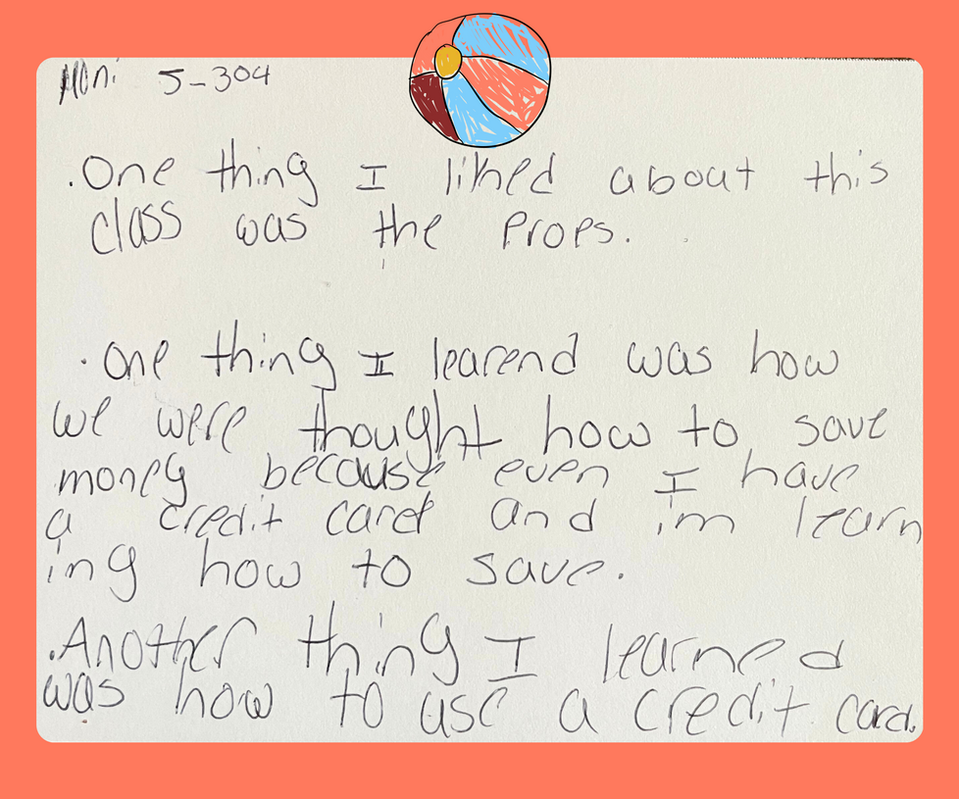

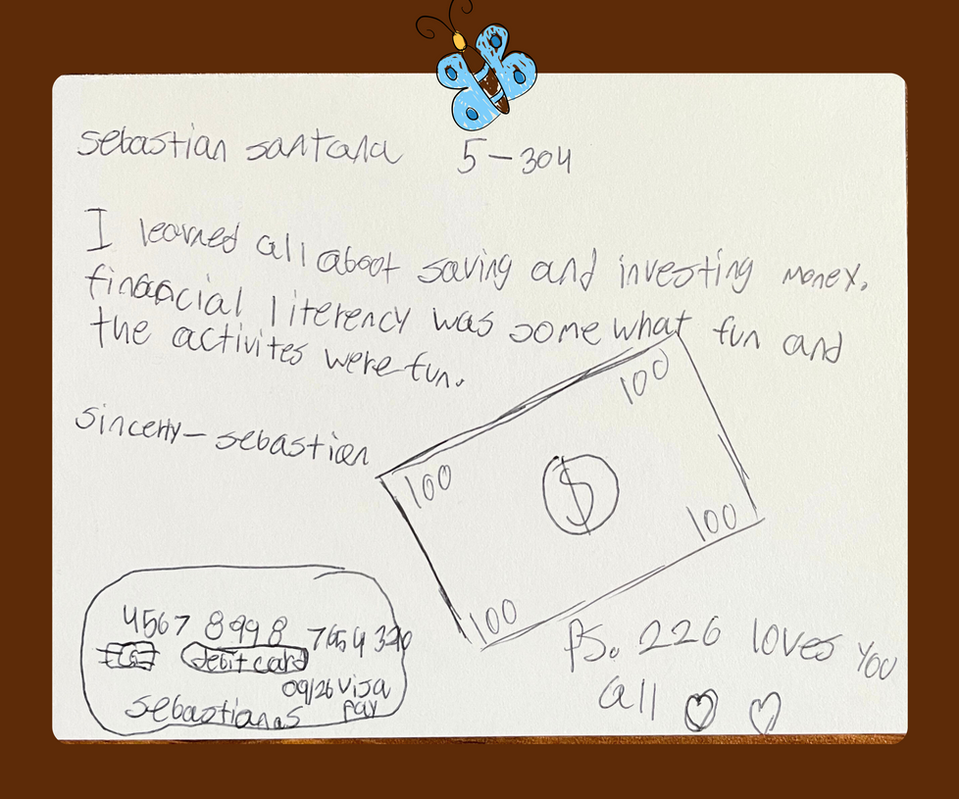

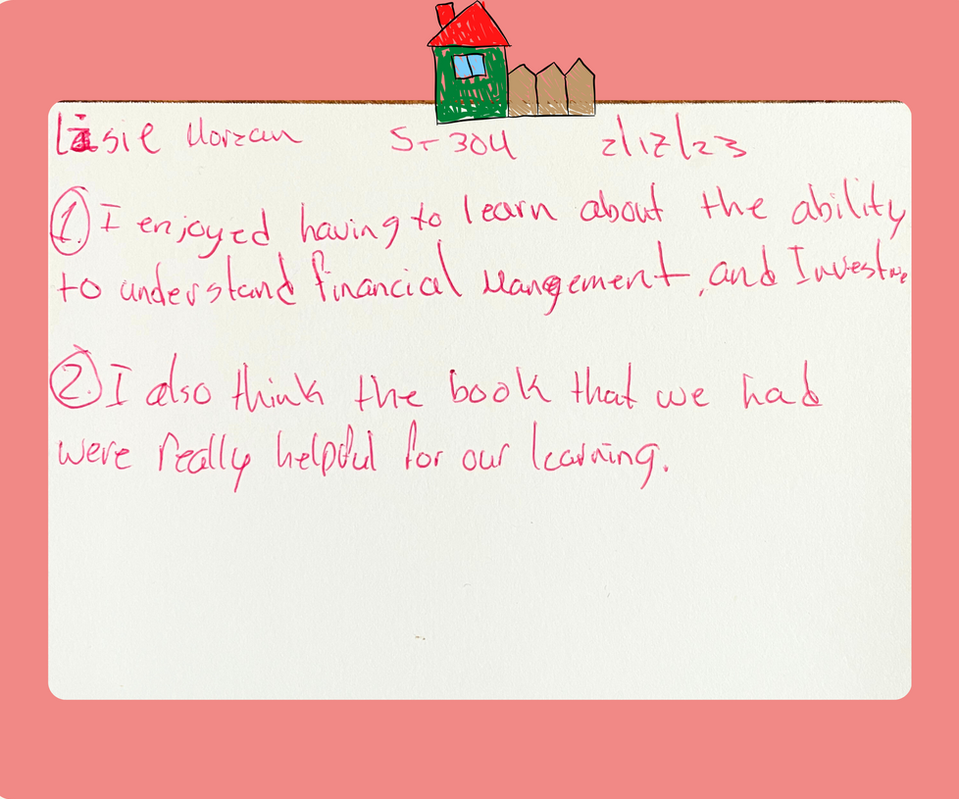

From interactive books to removable props, we offer touch-and-learn experiences that support teachers and help students build real-world money skills. FiWe’s resources earned a recommendation from New York City Public Schools after a rigorous review involving educators, families, students, and alumni, who loved our hands-on, visually engaging, and fully tech-free approach.

Grade 1

Our pop-up book turns financial literacy lessons into an interactive adventure. With colorful 3D scenes and lift-the-flaps, it gives children a tactile way to explore money concepts, practice skills, and connect ideas to everyday life — all while keeping learning screen-free and fun. Use it for Upper-K or Grade 1.

Grade 2

This course introduces key money concepts through lively activities that build early financial habits. Children practice spotting and counting coins, telling time, setting goals, budgeting, comparing prices, choosing needs over wants, saving, and weighing risks. The program is aligned to 2nd-grade math and counting-money standards, giving students a solid foundation for understanding value and making smart choices.

This book helps third graders take the next step in their money journey. Through lively lessons and activities, they learn how to earn money, tell needs from wants, save and grow funds with mini-budgets, spend smartly, share generously, and keep their money safe. Aligned with 3rd-grade math and financial literacy standards, it gives students a practical, screen-free way to build habits that last.

Grade 3

Building on earlier skills, this book takes students deeper into real-life money decisions. Through fun activities, they learn to set goals, budget, save, spend, bank, borrow smartly, spot ads, launch businesses, explore careers, and protect their money. It helps kids start connecting personal habits with the bigger world of work and money.

Grade 4

After gaining a foundation in earlier years, students now begin exploring a broader view of money and how it works. They explore barter to currency, see how prices and taxes affect what we buy, practice smart shopping, set bigger time-bound goals, and learn deferred gratification. They also take first investing steps, comparing saving and investing and tracking simple growth, so decisions start to look beyond this week and into the future.

Grade 5

Designed for students beginning financial literacy in middle school, this book starts at the ground floor. It includes key lessons from our elementary program presented for first-time learners - earning money, needs vs. wants, saving and goal-setting, simple budgets, smart shopping, banking basics, and how taxes show up in daily life. From there, students take first steps into investing and credit, setting them up for deeper topics in later grades.

Grade 6

From foundational skills, students now progress to real-world money management: earning income, reading paychecks and taxes, budgeting, using credit and understanding credit scores, protecting identity, banking confidently, and saving and investing with purpose. The course is appropriate for grades 7–10. As we continue to grow our library, we plan to release grade-assigned courses for the upper grades in the future.

Grades 7-10

TEACHER SUPPORT

FiWe’s resources are built not only for students but also for the teachers who guide them. Every program includes a printed Teacher Guide with detailed lesson plans and end-of-course project work, plus a math and social science crosswalk to make integration easy.

Scripted Guides – With culturally responsive notes and detailed lessons.

Training & Support – Online videos, key readings, and walkthroughs.

Classroom Ready Tools – Google Slides and crosswalks for easy integration.

Parent Programs

Financially Literate Parents, Money-Smart Kids!

Parental financial literacy is vital for instilling strong money management skills in children. Parental guidance in financial matters equips children to make wise decisions and create a solid foundation for their financial future.

We offer a range of programs for parents, covering financial wellness, debt management, 529 college savings plans, investing, to name a few. Our programs are flexible and can be customized. Contact us to discuss what program(s) will benefit your community the most.