Upper Grades

Pillar Program

| 24 Lessons |

| Comprehensive Concepts

| Foundational Knowledge |

| Flexible Implementation |

Banking

Credit Cards

Protecting Identity

Investing

Insurance

Careers & Income

College Savings

Finance Psychology

And so much more

Teacher

PD

Available

Interactive Books

Interactive Books

Look Inside

Fun, Hands-on & Impactful

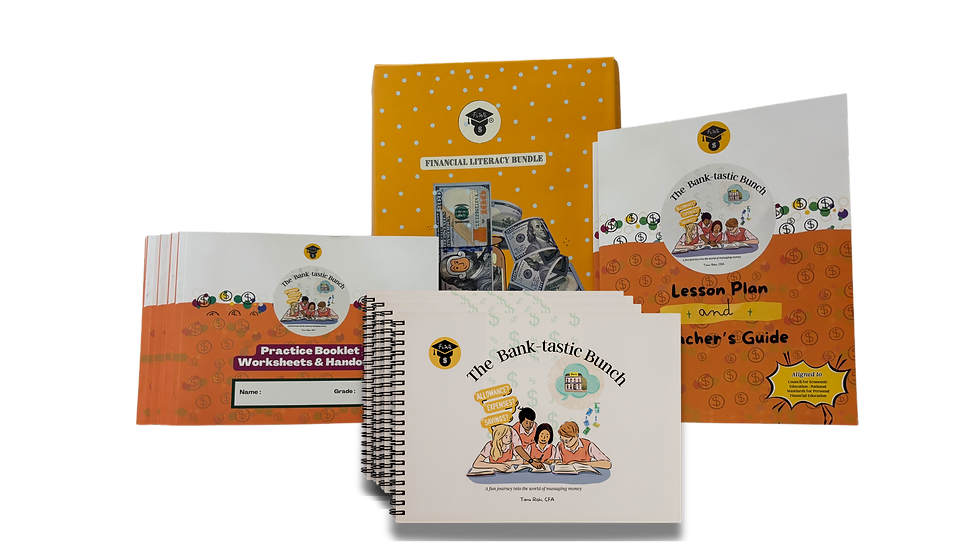

Interactive Workbooks Pair Perfectly with Teacher Resources

Interactive Books

Teacher Resources

Look Inside

Organized, Script based & Descriptive

Comes with Practice Booklet & Worksheets for each student

WAYS

TO TEACH

Each school’s needs are unique. Whether you’re looking to teach financial literacy for a few weeks, once a year, or as part of the curriculum, FiWe resources offer the flexibility to adapt to those needs. We recommend from the FOUR options to implement the program, giving schools the freedom to choose the approach that best suits their schedule and goals.

Whichever way you choose to implement, each program includes a set for the class with

-

25 interactive books

-

25 worksheet and practice booklets

-

2 teacher guides

ensuring you have all the materials needed for a successful learning experience.

Over a semester

A comprehensive 24-week program, teaching one topic each week throughout the year. Lessons are 45 minutes to an hour, making it ideal for reinforcing concepts and building strong financial habits over time.

Also perfect for after school programs.

1

A condensed option to cover all essential topics from our interactive book, perfect for schools that can dedicate a few weeks per year to financial literacy, like in April during the National Financial Literacy month.

Over a few weeks

3

Over a few months

For schools unable to dedicate an entire year, this option allows for a focus on key topics, prioritized by the school or with FiWe’s guidance, during select months of the year.

Also perfect for after school programs.

2

A special, dedicated day where schools can introduce students to essential financial concepts. Depending on the time allocated, schools can cover a few key topics and provide a fun, interactive financial literacy experience.